26+ income ratio for mortgage

Multiply your answer by. Get Your Quote Today.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

You have a pretax income of 4500 per month.

. Web Debt-To-Income Ratio - DTI. Highest Satisfaction for Mortgage Origination. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage.

Contact a Loan Specialist. The Standard Mortgage to Income Ratio Rules All loan programs. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall.

Web These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Easier Qualification And Low Rates With Government Backed Security.

For very tough boards the debt-to-income. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Your gross monthly income is the amount of income you bring home each month before taxes.

Lenders prefer you spend 28 or less of your gross monthly. Web The maximum debt-to-income ratio will vary by mortgage lender loan program and investor but the number generally ranges between 40-50. Web Based on the 28 percent and 36 percent models heres a budgeting example assuming the borrower has a monthly income of 5000.

Ad Easier Qualification And Low Rates With Government Backed Security. Ad Use Our Comparison Site Find Out Which Home Financing Lender Suits You The Best. Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments.

Web For example say that your total monthly obligations add up to 2000 when taking into account all your minimum payments and your new mortgage -- and say your. Web The DTI is calculated by adding your debt payment and dividing it by your gross monthly income. 1747 - 252 student loan - 503 car loan 992 maximum monthly mortgage payment.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web 18 hours agoFor a building that is considered moderate boards are looking for a 25 percent debt-to-income ratio Kory says.

Web 36 of 4853 monthly salary 1747 total debit based on debt-to-income ratio. Web Here are debt-to-income requirements by loan type. Web Lowering debts or increasing your income will lower your DTI which could help you qualify for a better mortgage loan.

Web If your income varies estimate a typical months earnings. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. VA Loan Expertise and Personal Service.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Divide your total monthly debt payments by your gross monthly income. Compare Offers From Our Partners To Find One For You.

Web According to this rule a household should spend a maximum of 28 of its gross monthly income on total housing expenses and no more than 36 on total debt. Here are some examples of DTI in action. 5000 x 028 28 1400.

Compare Offers From Our Partners To Find One For You. An addition to the 28 rule is the 2836 rule or the back-end. Apply Online To Enjoy A Service.

Web Debt-to-income ratio total monthly debt paymentsgross monthly income. Your monthly expenses include 1200. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

If your home is highly energy-efficient. Youll usually need a back-end DTI ratio of 43 or less.

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Debt To Income Ratio Dti What It Is And How To Calculate It

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Pdf Financialization And Housing Between Globalization And Varieties Of Capitalism

Dallas Mortgage Lender 888 435 7190 Best Mortgage Rates Home Purchase Home Refinance Texas Cash Out Mortgage Dfw Mortgage Lender Best Rates For Veterans

Debt To Income Ratios Home Tips For Women

The Real Effects Of Bank Distress Evidence From Bank Bailouts In Germany Sciencedirect

Percentage Of Income For Mortgage Rocket Mortgage

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

How Much Can I Afford Home Loan Affordability Calculator

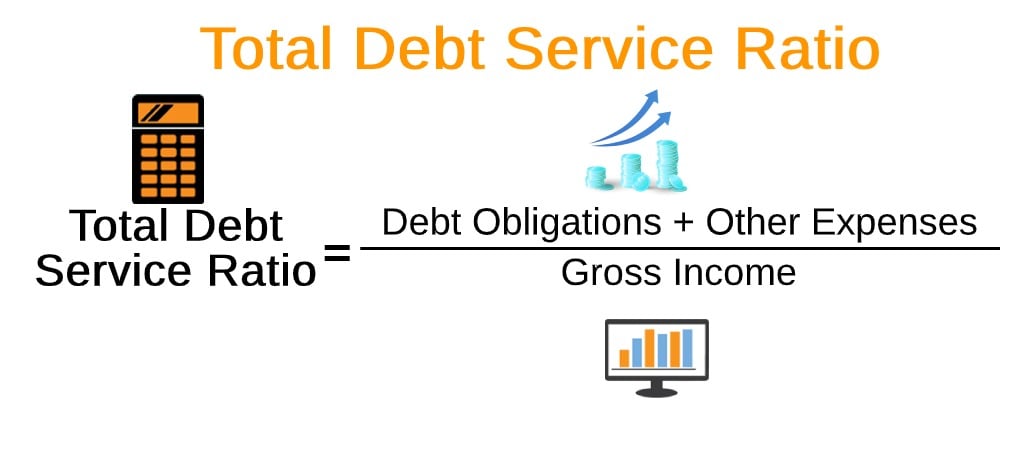

Total Debt Service Ratio Explanation And Examples With Excel Template

Best Mortgage Lenders Of March 2023 Lendstart

What Is Margin Money In House Loan Topic 19 Bankingtutorial Learn Banking With Easy Tips Banking Youtube

:max_bytes(150000):strip_icc()/RulesofThumb-ArticlePrimary-1a49faa8c635412db26a844b57ee2009.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

Best Mortgage Lenders Of March 2023 Lendstart